公司简介

Company Introduction

云投行资本管理公司(CIBCM)是一家位于中国深圳的专业管理海外资金的私 募股权投资管理机构,公司符合中国政府关于管理外商投资股权基金的条件: 合格境外有限合伙人QFLP(Qualified Foreign Limited Partne r)管理资格,可以合法募集海外资本,在中国境内设立外商投资股权投资基金,投资国内的符合外商投资条件的企业。

Cloud Investment Bank Capital Management Company (CIBCM) is a private equity investment management institution located in Shenzhen, China, specializing in managing overseas funds. The company has qualified with managing foreign investment equity funds: QFLP (Qualified Foreign Limited Partner ) can legally raise overseas capital, establish foreign investment equity investment funds within China, and invest in domestic enterprises that above the conditions for foreign investment.

公司目前管理规模64亿元人民币(约10亿美元),实际管理两个QFLP基金,拥有管理外商投资股权投资基金的实际经验,专业服务海外资金通过股权投资合法投资中国。

The company currently manages a scale of 6.4 billion yuan ( approximately 1 billion US dollars) and actually manages two QFLP funds. It has practical experience in managing foreign-invested equity investment funds and provides professional services for overseas funds to legally invest in China through equity investment.

公司拥有专业的投资管理管理团队,在基金设立、投资研究、项目的尽调、投资决策、投后管理等方面经验丰富,拥有中国大陆本土投资的各类必备能力。

The company has a very professional investment management team, especially in fund establishment, investment research, project due diligence, investment decision-making, post investment management, etc., and various necessary capabilities for local investment in Chinese Mainland.

公司对投资中国坚持“产业优先”、“长期主义”、“国际合作”的理念,愿意服务各国专业的投资人,就国际资金从事中国股权投资、创业投资提供专业的投资管理服务,促进国际资本的正常投资,推动各类有利于产业发展和社会福利的国际间资本流动。

The company adheres to the concept of "industry priority", "long-term ism", and "international cooperation" in investing in China, and is willing to serve professional investors from various countries. It provides professional investment management services for international funds engaged in Chinese equity investment and venture capital, promotes normal investment of international capital, and promotes various international capital flows that are conducive to industrial development and social welfare.

QFLP业务介绍

QFLP Business Introduction

QFLP业务介绍

QFLP Business Introduction

一、政策背景:

1、 Policy background:

投资中国是全球资产配置的重要部分,投资中国的产业将成为获取长期可持续投资价值的重要一环。

Investing in China is an important part of global asset allocation, and investing in China's industries will become an important part of obtaining long-term sustainable investment value.

中国QFLP试点政策允许符合条件的外国投资者出资参与在中国境内设立QFLP基金,在获批准的外汇额度范围内,以外汇资本金结汇所得人民币资金在中国境内开展股权投资。

The QFLP pilot policy in China allows eligible foreign investors to contribute and participate in the establishment of QFLP funds in China. Within the approved foreign exchange quota, RMB funds obtained from foreign exchange capital settlement are used to carry out equity investments in China.

中国是跨国公司在全球范围内最重要的市场之一,QFLP基金是外商开展境内股权投资的重要通道之一,也是国家和地方政府推动跨境投资便利化的重要举措。现阶段众多外商投资企业将通过QFLP基金 持续投资中国、深耕中国,与开放包容的中国共创美好未来。

China is one of the most important markets for multinational corporations worldwide, and the QFLP fund is an important channel for foreign investors to conduct domestic equity investments. It is also an important measure for national and local governments to promote the facilitation of cross-border investment. At present, many foreign-invested enterprises will continue to invest in China and deeply cultivate China through the QFLP fund, creating a better future together with an open and inclusive China.

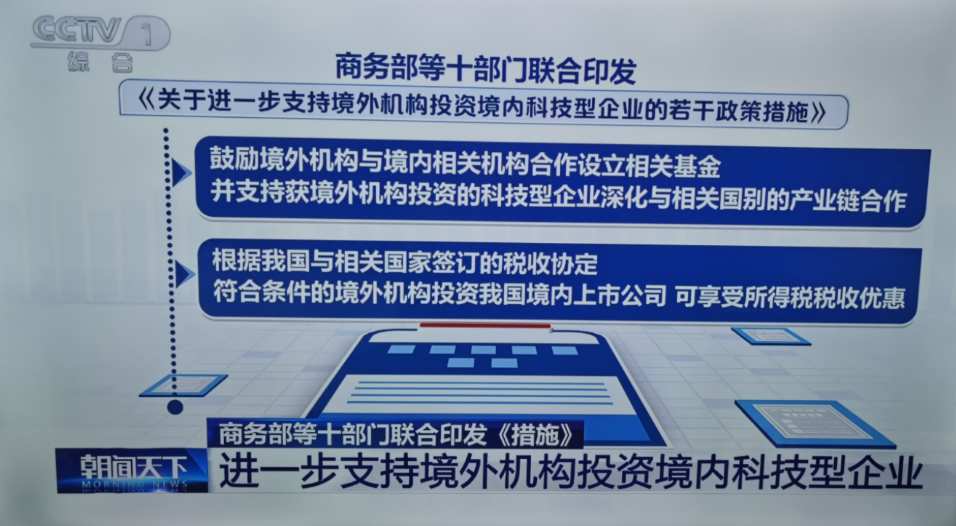

2024年4月1 9日,中国商务部、外交部、国家发展改革委、科技部、工业和信息化部、中国人民银行、税务总局.金融监管总局、中国证监会、国家 外汇局十部门联合印发《关于进一步支持境外机构投资境内科技型企业的若干政策措施》,将扩大面向境内科技型企业股权投资的QFLP额度,允许境外机构通过QFLP渠道投资单个境内科技型企业(允许项目直投)。

On April 19, 2024, the Ministry of Commerce, the Ministry of Foreign Affairs, the National Development and Reform Commission, the Ministry of Science and Technology, the Ministry of Industry and Information Technology, the People's Bank of China, the State Administration of Taxation, the State Administration of Financial Supervision, the China Securities Regulatory Commission, and the State Administration of Foreign Exchange jointly issued the "Several Policy Measures on Further Supporting Overseas Institutions to Invest in Domestic Science and Technology Enterprises", which will expand the QFLP quota for equity investment in domestic science and technology enterprises and allow overseas institutions to invest in individual domestic science and technology enterprises through the QFLP channel (allowing direct project investment).

二、QFLP相关主体

2、 QFLP related entities

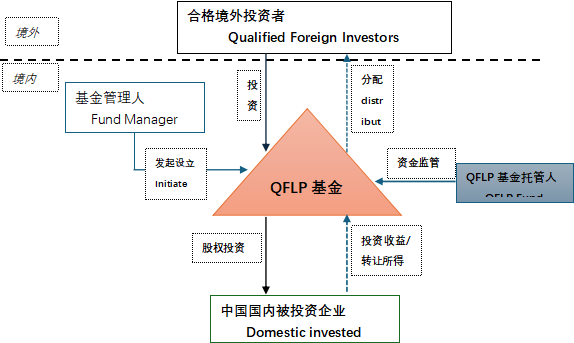

QFLP(Qualified Foreign Limited Partner,合格境外有限合伙人)基金主要指境外机构投资者在完成资格审批和外汇资金的监管程序后,由境外投资者作为有限合伙人认缴基金出资的私募股权基金 ,将境外资本可通过QFLP试点政策在基金层面申请额度结汇为人民币,基金对外投资时以人民币投出 ,投资于中国的私募股权投资(PE)和风险投资(VC)市场。这种投资方式有助于突破外商投资准入和资本项目结汇的限制,为 中国国内股权投资市场引入外资。

QFLP (Qualified Foreign Limited Partner) fund mainly refers to a private equity fund in which foreign institutional investors, after completing qualification approval and foreign exchange fund supervision procedures , subscribe to the fund as a limited partner by foreign investors. Foreign investors can apply for a quota at the fund level through QFLP pilot policies to settle foreign exchange in RMB , and invest in the Chinese private equity investment (PE) and venture capital (VC) markets in RMB when investing abroad. This investment method helps to break through the restrictions on foreign investment access and capital account settlement, and introduce foreign investment into China's domestic equity investment market.

合格境外投资者:即外国投资者(含境外自然人、企业或其他组织等),参与在中国境内投资设立基金

Qualified foreign investor: refers to foreign investors (including foreign natural persons, enterprises, or other organizations) who participate in the investment and establishment of funds within China

QFLP基金管理企业 :以发起设立或受托管理外商投资股权投资企业为主要经营业务的股权投资管理企业(需要中国证券业投资基金协会备案的私募基金管理人) ,组织形式可以为公司制、合伙制等

QFLP Fund Management Enterprise : an equity investment management enterprise whose main business is to initiate the establishment or entrusted management of foreign-invested equity investment enterprises (a private fund manager who needs to be registered with the China Securities Investment Fund Association) , and its organizational form can be corporate, partnership, etc

QFLP基金:即由外国投资者参与投资设立,以在中国境内开展股权投资为主要业务的股权投资企业,组织形式可以为公司制、合伙制等(部分地区也可采用契约制)

QFLP Fund: refers to an equity investment enterprise established by foreign investors with the main business of conducting equity investment within China. Its organizational form can be corporate, partnership, etc. (some regions may also adopt a contractual system)

QFLP基金托管人:试点地区具有资质的金融机构,作为托管人对投资行为、托管账户及资金使用等进行监督 。

QFLP Fund Custodian: Qualified financial institutions in pilot areas act as custodians to supervise investment behavior, custody accounts, and fund usage .

中国政府QFLP基金监管流程

Chinese government QFLP fund regulatory process

3 、 Chinese government QFLP fund regulatory process

(1) QFLP基金管理 企业取得QFLP试点资格及募集境外资金规模(“管理企业的QFLP总规模”);

(1) QFLP fund management enterprises obtaining QFLP pilot qualifications and raising overseas funds ("total QFLP scale of managed enterprises" );

(2) QFLP基金管理 企业在注册地外汇局办理QFLP总规模外汇登记手续;

(2) QFLP fund management enterprises shall handle the foreign exchange registration procedures for the total scale of QFLP at the foreign exchange bureau of their registered location;

(3) QFLP基金管理 企业在QFLP总规模的范围内,发起成立一只或多只QFLP基金;

(3) QFLP fund management enterprises initiate the establishment of one or more QFLP funds within the total scale of QFLP;

(4) QFLP基金管理 企业委托境内具有托管资质的金融机构作为试点基金的托管人;

(4) QFLP fund management enterprises entrust domestic financial institutions with custody qualifications as the custodians of pilot funds;

(5)为每只OFLP基金应开立QFLP专用账户,用于存放境外合伙人从境外汇入或境内划入的出资;

(5) A dedicated QFLP account should be opened for each OFLP fund to store the contributions of overseas partners remitted or transferred from overseas or domestically;

注:QFLP专用账户收入范围是:境外合伙人从境外汇入或境内划入的投资资金;从募集账户划入资金;经外汇局核准的其他收入。

Note: The income range of the QFLP dedicated account is: investment funds remitted or transferred from overseas or domestically by overseas partners; Transfer funds from the fundraising account; Other income approved by the State Administration of Foreign Exchange.

QFLP专用账户支出范围是:对外支付投资收益、与基金赎回有关的投资本金以及其他业务相关的经常项目支出(如税费);结汇或直接划入募集账户;经外汇局核准的其他支出

The expenditure scope of QFLP dedicated account includes: external payment of investment returns, investment principal related to fund redemption, and other current account expenses related to business (such as taxes and fees); Foreign exchange settlement or direct transfer to the fundraising account; Other expenditures approved by the State Administration of Foreign Exchange

(6)QFLP基金运营中,根据实际需要办理资金汇入汇及结汇购汇业务;

( 6)In the operation of QFLP fund, handle fund inflow and foreign exchange settlement and purchase business according to actual needs;

(7)基金管理企业定期就QFLP基金情况向外汇管理部门及地方金融监管部门进行信息报备;

(7) Fund management companies regularly report information on the QFLP fund situation to foreign exchange management departments and local financial regulatory authorities;

(8)如QFLP总现 模发生 变化,基金管理企业应向注册地外汇局办理变更登记业务;

(8) If there is a change in the overall QFLP model, the fund management enterprise should handle the change registration business with the foreign exchange bureau in the place of registration;

(9)QFLP基金清盘时,向银行提交基金完税证明及基金清盘及清算资金汇出的交易真实性证明后,办理购付汇及资金汇出手续;

(9) When QFLP fund is liquidated, after submitting the fund tax payment certificate and the transaction authenticity certificate of fund liquidation and clearing fund remittance to the bank, the purchase and payment procedures for foreign exchange and fund remittance shall be completed;

(10) QFLP基金管理 企业退出OFLP试点业务后,基金管理企业应到注册地外汇局办理QFLP总规模注销登记。

(10) After QFLP fund management enterprises exit the pilot business of OFLP, they should go to the foreign exchange bureau in their registered place to handle the cancellation registration of the total scale of QFLP.

QFLP基金设立流程

QFLP Fund Establishment Process

4 、 QFLP Fund Establishment Process

设立QFLP基金管理人和基金的程序主要包括五个环节,即向地方金融办提交材料、评审、工商注册、外商企业信息登记、基金备案等流程。

The process of establishing a QFLP fund manager and fund mainly includes five steps, namely submitting materials to the local financial office, evaluation, industrial and commercial registration, foreign enterprise information registration, fund filing, and other processes.

(一)提交申请材料

(1) Submit application materials

QFLP试点的发起人向地方领导小组递交申请文件,一般同时包括管理企业和QFLP基金的材料,申请QFLP管理人的材料包括试点申请书、营业执照、公司章程/合伙协议、各类无违法违规记录的承诺函等资质文件,还对境外募资能力提出要求,如要求提供具有境外募集资金能力的说明及相关证明或投资业绩证明。

T he initiator of the QFLP pilot project submits application documents to the local leadership group, generally including materials for managing both the enterprise and the QFLP fund. The materials for applying for a QFLP manager include qualification documents such as the pilot application, business license, company articles of association/partnership agreement, and commitment letters without any illegal or irregular records. They also require the ability to raise funds overseas, such as providing an explanation of the ability to raise funds overseas and relevant certificates or investment performance certificates.

具体向工作小组办公室递交如下申请材料 :

Submit the following application materials to the working group office :

( 一 )设立外商投资股权投资管理企业或外商投资股权投资企业申请书;

(1)Application for establishing a foreign-invested equity investment management enterprise or a foreign-invested equity investment enterprise;

(二)商业计划书或可行性研究报告:

(2)Business plan or feasibility study report:

(三)申请企业基本资料,包括:募集说明书、合伙协议、企业章程等;

(3)Apply for basic information of the enterprise, including: prospectus, partnership agreement, articles of association, etc ;

(四)法定代表人和董事会人员名单、简历、身份证复印件基金从业的有关证明材料(如有);

(4)List of legal representatives and members of the board of directors, resumes, copies of ID cards, and relevant supporting documents for fund employment (if any);

(五)经所在国家公证机关公证并经我国驻该国使(领)馆认证的外国投资者的注册登记证明或身份证明文件,香港、澳门或台湾地区投资者应当依法提供经当地公证机构公证的注册登 记证明或身份证明文件,投资者资信证明文件;

( 5 ) Foreign investors in Hong Kong, Macau, or Taiwan should provide a registration certificate or identity document notarized by the local notary public and authenticated by the Chinese embassy (consulate) in their respective country. Investors in Hong Kong, Macau, or Taiwan should also provide a registration certificate or identity document notarized by the local notary public in accordance with the law, as well as an investor's credit certificate;

(六)持有境外金融机构监管部门金融业务牌照情况(如有):

(6)Holding of financial business licenses from regulatory authorities of overseas financial institutions (if any):

(七)自有资产及管理资产有关证明材料(提供经会计师事务所审计的财务报告或 其他第三 方机构出具的有效证明);

(7)Proof materials related to self owned and managed assets (providing financial reports audited by accounting firms or valid certificates issued by other third-party organizations);

(八)个人投资者需提供个人资产和收入情况证明:

(8)Individual investors are required to provide proof of their personal assets and income situation:

(九)申请人出具的上述全部材料真实性的承诺函:

(9)The applicant's commitment letter regarding the authenticity of all the aforementioned materials:

(十)工作小组要求的其他材料。

(10)Other materials required by the working group.

(二)地方评审

(2)Local review

中国地方政府通过联合会商工作机制完成相关QFLP基金设立试点审批,一般由地方政府 市 级 金融局 牵头,汇 同 市发改委 ( 市商务局 ) 、市场监督管理局、外管局 ×× 市分局 进行会商, 由各地的领导小组负责QFLP企业的评审认定。领导小组大多设立在地方金融监督管理局。

The Chinese local government completes the pilot approval for the establishment of QFLP funds through a joint consultation mechanism. Generally , the local government's municipal financial bureau takes the lead, and consults with the Municipal Development and Reform Commission ( Municipal Bureau of Commerce ) , Market Supervision Administration, and XX Municipal Branch of the State Administration of Foreign Exchange. The leading groups in each region are responsible for the evaluation and recognition of QFLP enterprises. Most leadership groups are established in local financial supervision and management bureaus.

领导小组在收到申请文件后,需在 一 定时限内进行评审并给出评审意见,一般而言在5个工作日内决定是否受理、10个工作日内开始评审、30个工作日内给出评审意见。

After receiving the application documents, the leadership group needs to conduct a review and provide review opinions within a certain time limit. Generally, the decision on acceptance should be made within 5 working days, the review should start within 10 working days, and the review opinions should be provided within 30 working days.

(三)试点企业认定

(3)Certification of pilot enterprises

经评审符合试点要求的,由领导小组出具“同意函”或“认定通知书” 方可办理工商登记注册 ;评审不通过的,由领导小组书面通知申请人。

If it meets the pilot requirements after evaluation, the leading group shall issue a "consent letter" or "recognition notice" before applying for industrial and commercial registration ; If the evaluation fails, the leadership group shall notify the applicant in writing.

(四)工商注册及外商企业信息登记

(4)Business registration and foreign enterprise information registration

经认定符合条件的试点企业,凭领导小组出具认定资料,到工商部门办理注册登记手续,部分地区还规定取得试点资格的企业应在3个月或6个月内办理企业登记手续。

Pilot enterprises that have been identified as meeting the conditions shall go to the industrial and commercial department for registration procedures with the certification materials issued by the leadership group. Some regions also require enterprises that have obtained pilot qualifications to complete enterprise registration procedures within 3 or 6 months.

取得营业执照后, 凭工商 登记材料办理外汇登记、外商投资企业信息报告等外汇管理手续。

After obtaining the business license, handle foreign exchange management procedures such as foreign exchange registration and foreign investment enterprise information reports with the industrial and commercial registration materials.

(五)基金监管及托管

(5) Fund supervision and custody

按照基金业协会及地方QFLP政策的要求,需寻找满足监管要求的金融机构开立募集 监管 户 及托管户 。

According to the requirements of the Fund Industry Association and local QFLP policies, it is necessary to find financial institutions that meet regulatory requirements to open fundraising regulatory accounts and custody accounts .

(六) QFLP 基金 产品 备案 及投资

(6) QFLP Fund Product Filing and Investment

如果只有纯境外投资者,无中国境内投资者,按 中国证券投资基金业协会 《备案管理办法》,对 纯外资 的基金 ,因不涉及境内募集,所以, 中国证券投资基金业协会不 强制要求基金产品 备案, 但有些试点地方要求 不备案就不能作为QFLP 进投资 和换汇结汇; 同时对于 境内基金管理人设立的 QFLP基金 ,不去备案境内管理人 存在 有合 规 风险,如果提交了备案申请被窗口劝退 则可以反馈给托管银行后不用备案也 可使用外汇资金对其发起设立的QFLP出资,QFLP向托管银行发起指令,委托办理外汇资金境内投资。

If there are only pure foreign investors and no domestic investors in China, according to the "Filing Management Measures" of the China Securities Investment Fund Industry Association , for pure foreign funds , as they do not involve domestic fundraising, the China Securities Investment Fund Industry Association does not require fund product filing. However, in some pilot areas, if not filed, they cannot be used as QFLP for investment and exchange settlement; At the same time , for QFLP funds established by domestic fund managers, there is a compliance risk of not filing with domestic managers. If the filing application is rejected by the window, feedback can be given to the custodian bank, and foreign exchange funds can be used to invest in QFLP funds established without filing . QFLP issues instructions to the custodian bank and entrusts them to handle domestic investment of foreign exchange funds.

大多地区要求试点管理人在12个月内完成募集,试点基金管理企业自登记注册之日起12个月内未能取得中国证券投资基金业协会登记的,或自登记为管理人之日起12个月内未能完成首次基金募集并备案的,予以取消试点资格。

Most regions require pilot fund managers to complete the fundraising within 12 months. If a pilot fund management enterprise fails to obtain registration with the China Securities Investment Fund Industry Association within 12 months from the date of registration, or fails to complete the initial fund fundraising and filing within 12 months from the date of registration as a manager, its pilot qualification will be cancelled.

(七)信息报告

(7) Information report

信息报送方面,在QFLP试点企业落地后,各地QFLP试点政策均要求企业向地方政府主管部门报送信息,通常为定期向联审办公室提交业务报告(包括资金汇兑、投资收益)、托管银行有关资金托管报告、经审计的年度财务报告、每季度投资运作过程中的重大事件报告。

In terms of information submission, after the landing of QFLP pilot enterprises, QFLP pilot policies in various regions require enterprises to submit information to local government authorities, usually by regularly submitting business reports (including fund exchange and investment returns) to the joint audit office, relevant fund custody reports from the custodian bank, audited annual financial reports, and quarterly reports on major events during investment operations.

除向QFLP试点企业所在地政府主管部门报送信息之外,企业后续运营还需关注私募规定及自律规则的相关要求,履行信息报送和披露义务。

In addition to submitting information to the local government authorities where the QFLP pilot enterprise is located, the enterprise's subsequent operations also need to pay attention to the relevant requirements of private equity regulations and self-discipline rules, and fulfill the obligation of information submission and disclosure.

基金架构

Fund structure

基金税务

Fund Taxation

|

纳税主体 Taxpayers |

收入类别 Income category |

税务处理 Tax processing |

|

合伙制QFLP基金 Partnership QFLP Fund |

股息\红利所得 Dividends/income from dividends 股权转让所得 Income from equity transfer

转让金融商品\保本利息收入(如有) Transfer of financial products/guaranteed interest income (if any) |

所得税:先分后税,该合伙企业不是企业所得税的纳税人,无须纳税。 Income tax: Divided first and then taxed. The partnership enterprise is not a taxpayer of corporate income tax and therefore does not need to pay taxes. 增值税:合伙制QFLP基金本身是增值税纳税义务人,发生应税行为的,按6%(一般纳税人)/3(小规模纳税人)缴税 Value added tax: The partnership QFLP fund itself is a value-added tax taxpayer, and if taxable activities occur, it will be taxed at a rate of 6% (general taxpayer)/3% (small-scale taxpayer) |

|

境外投资者(LP) Foreign Investors (LP) |

股息\红利所得 Dividends/income from dividends 股权转让所得 Income from equity transfer |

法规层面无明确规定,根据现行税法,在境内未设立“机构、场所”或虽设立“机构、场所”但取得的所得与其无实际联系的,则就来源于境内所得按10%缴纳预提所得税。 There is no clear regulation at the regulatory level. According to the current tax law, if there is no "institution or place" established within the country, or if there is no actual connection between the "institution or place" and the income obtained, a 10% withholding income tax shall be paid on income sourced from within the country. |

|

基金管理人(GP) Fund Manager (GP) |

管理费/咨询费收入 Management fee/consulting fee income |

企业所得税25%,增值税按6%(一般纳税人)/3(小规模纳税人)缴税 Enterprise income tax is 25%, and value-added tax is paid at a rate of 6% (general taxpayers)/3 (small-scale taxpayers) |

联系方式

Contact Information

Our Address

Room 1211,zhongguang Times Square NO.4068 Liuxian,Nanshan District Shenzhen City, CHINA.

Email Us

1211677@qq.com

313801994@qq.com

Call Us

+86-13802297835

+86-15012884534